![Best ,[object Object], in the UAE](/_next/image?url=%2F_next%2Fstatic%2Fmedia%2FresidentsService.f3d9c517.jpg&w=3840&q=75&dpl=dpl_qjciQzoWA453FgUNZHLCoCwUfvVw)

Best Home Loans for Residents in the UAE

BNW Mortgages delivers premium home loan solutions for UAE residents at highly competitive mortgage rates.

Interest rates from

3.70%

Loan-to-value upto

85%

Loan tenure upto

25 Years

* T&Cs apply. Contact our team for details.

Find Your Path to Home Ownership

Whether you’re salaried or self-employed, we offer tailored mortgage solutions. Here’s a quick comparison based on UAE mortgage regulations.

For Salaried Individuals

- Eligibility Criteria

Based on a consistent monthly salary transferred to a UAE bank account. - Key Documents

Salary Certificate, 3-6 months' bank statements, and passport/visa copies. - Debt Burden Ratio (DBR)

As per UAE Central Bank, total monthly debt payments cannot exceed 50% of your gross monthly income. - Approval Process

Generally faster and more streamlined due to predictable income verification.

For Self-Employed

- Eligibility Criteria

Based on business stability and proven profitability over a period of time. - Key Documents

Audited financials (2-3 years), company bank statements, Trade License, and Memorandum of Association (MOA). - Income Assessment

Income is calculated based on average business profits, requiring a more detailed financial review. - Approval Process

Involves a comprehensive assessment of the business's health, which may take longer.

How Does It Work?

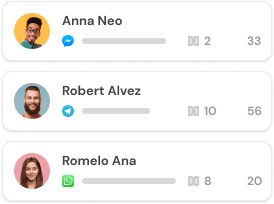

Initial Consultation

The first step in the process is getting a consultation session with our reputed advisor. Our in-house advisors offer customised guidance to make sure you are making a well-informed decision. We help you understand the mortgage calculator to help you figure out how much you can borrow based on your current financial situation.

One to One meeting with Expert

Understand your borrowing power

Finding the Best Options for You

After you have used the calculator and consulted with our advisors, we will schedule another session wherein our advisors will help you identify the best options available for you. We will guide you through the most optimal mortgage options to suit your needs and requirements.

Review available loan products

Identification of the best mortgage

Select from tailored mortgage choices

Pre-approval

During the pre-approval stage, we evaluate your income documents. Before the loan disbursal, we verify the property documents as well. It is a conditional approval from us for your specific loan amount, depending on an evaluation of your creditworthiness, financial health, and repayment capacity.

Evaluation of your income documents

Verification of property details

Get conditional loan approval

Application and Paperwork

To ensure a smooth home mortgage process, you need to submit a duly filled application along with necessary documents such as income proof, identity proof, and address proof, among others. In the event you are applying with a co-applicant, you need to submit the same set of documents for the co-applicant as well.

Submit your completed application

Provide all necessary documents

Complete the co-applicant process if needed

Moving to Your New Home

The next process is the sweet little prize you were working all along for. Move into your new dream house. Nothing makes us happier than helping you fulfil your lifelong dream of owning a house to check off your bucket list.

Finalize all the legalities

Receive the keys to your property

Welcome to your new home!

Ongoing Support

Our services are not just limited to mortgage disbursement. We also provide ongoing support and resources to you to assist you with managing your loans and addressing potential issues. We stay in touch with you and keep you updated about your loan status.

Assistance with loan management

Support for any potential issues

Receive regular status updates

Advantages of working with us

Frequently

Asked Questions

Don’t get Answer?

We will answer you in less than 2 Hours!!

Don’t get Answer?

We will answer you in less than 2 Hours!!